The Impact of US Tariffs on the Asian Economic Markets

The risk of rising money laundering

This article explores the potential risk of a rise in trade-based money laundering as a result of global tariffs imposed by President Trump on Asian economic markets.

Money laundering refers to disguising earnings from criminal activities as legitimate sources of income. [1] Moreover, trade-based money laundering is the movement of concealed illicit financial assets through trades. [2] Money laundering can influence and reflect the rate of corruption prevalent in the private and public sectors of a state. Consequently, with higher levels of money laundering and poorer systems to counter it, foreign direct investment and gross domestic product could decrease. [3]

The Asian markets have a significant influence on global trade and economics, with rising investment opportunities, and account for approximately 60% of the global population[4]. Nonetheless, President Trump’s high tariff rates have significantly impacted the Asian economic markets, as seen in the graph below: 46% on Vietnam, 36% on Thailand, 32% on Indonesia, and 26% on India[5]. Conversely, China’s retaliatory tariffs sparked an escalation of tariff imposition by the United States on China to 145%. As a result, many Asian states are planning to engage in negotiations to reduce the level of tariffs[6], as unlike China, they lack the capability to retaliate and these tariffs can hinder their economic growth, as a significant proportion of their exports go to the US, with estimates for Vietnam at 29%, India and Thailand at 17%, and China at 15%. [7] Furthermore, tariffs cause significant direct and indirect impacts on gross domestic product (GDP), foreign direct investment (FDI), stocks, trade, and overcapacity for businesses. [8] Thus, many of these countries may have to give in to concessions and demands by the US government. Alternatively, the Association of Southeast Asian Nations (ASEAN) and other Asian states may jointly cooperate further to strengthen their position to counter the US tariffs and better align with international trade regulations. [9] However, engaging in diplomatic discussions and collective strategy and agreements to implement the newly revised international trade policy will take considerable time. Meanwhile, illicit financial trade and money laundering practices may increase to evade these tariffs.

Additionally, there are previous case studies that offer insight into the relationship between trade tariffs and trade-related money laundering. Therefore, when the US previously imposed tariffs on China, during a trade war between 2018-2020, this led to an influx of trade-based money laundering with increased tariffs issued under the US Trade Act. Consequently, Chinese exports resorted to using illicit financial activities, mainly by disguising the origins of their goods. This scheme resulted in Chinese goods being sent to other countries in Southeast Asia, where they were mislabeled as goods originating from those countries and later re-exported to the US, while the profits were received through offshore bank accounts and cryptocurrencies, thus enabling companies using this scheme to avoid detection. Only later in 2019 did the US Customs and Border Protection impose penalties and enhanced procedures to combat such trading practices. [10]

Therefore, an increase in tariffs can significantly influence the rate of white-collar crimes and illicit trading activities. The US tariffs and potential sanctions will continue to impact industries and the Asian market, thus pushing international trade dynamics into a new era of compliance. Moreover, the constant pressure to respond to drastically changing regulations and the need to conduct revised risk assessments to navigate these newly established tariffs could facilitate trade-based money laundering and other innovative forms of financial crimes to bypass these new trade barriers and global trade dynamics. [11]

This will pose a challenge for anti-money laundering (AML) based solutions as these initiatives rely on technologies to enable monitoring and detection, particularly in developing economic markets. Therefore, the tariffs have increased the costs of acquiring technological components essential for certain AML systems from countries such as China. Conversely, for industries and companies that cannot keep up with the necessary costs of quality, reliable AML technological systems, this will cause a delay in upgrading and modernizing their systems and thereby reduce the possibility of maintaining compliance with company and jurisdictional standards. This will considerably limit the detection of illicit money laundering activities.

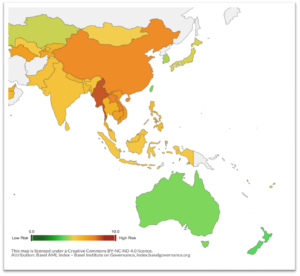

Even if US companies change to alternative supplier states, for instance, India or Vietnam, new challenges will emerge as different jurisdictions have different compliance standards over software and hardware components used in AML technological systems. However, it is too soon to tell whether the rates of money laundering have been affected due to the increase in tariffs. A recent graph depicts Asia-Pacific countries and their overall money laundering risk score in 2024, reflecting which countries are currently struggling to address this challenge and are now more at risk due to the rapidly evolving geopolitical economic trade through tariffs. [12]

Nevertheless, efforts have been made to deal with general fraudulent practices with trade-related and other forms of money laundering. Based on previous case studies, several legal firms have reported that countries with steep tariffs imposed on their goods imported into the US have adopted fraudulent practices to evade additional duties and/or costs. [13] The US Department of Justice has resorted to enforcing the False Claims Act, an influential US government act that tackles issues of fraud, to address the illicit financial activities within the changing dynamic of global trade networks connected to the US. [14] While this may be effective through the courts, the law will not extend to other states and prevent the totality of illicit trading and financial laundering activities entering the US from Asia and vice versa.

Furthermore, while many Asian countries may have agencies and laws in place to address trade and money laundering activities, the operational level varies from that of the US and other countries. As shown in the graph, Korea, Taiwan, and Kazakhstan operate better than Myanmar, Laos, and Cambodia. As noted previously, the level of money laundering detected and reported can be addressed by the relevant authorities under their respective jurisdictional laws. However, undetected trade and money laundering activities will still filter into the US and Asian financial markets, impacting their financial systems. Hence, the US government should consider enhancing trade and business cooperation with Asian states that can address money laundering challenges, rather than imposing existing and/or future trade tariffs.

In conclusion, President Trump’s decision to impose tariffs has inadvertently caused a shift in trade-based relations with Asian countries. However, considering growing concerns from various stakeholders, President Trump announced a 90-day pause on tariffs. [15] Countries in Asia should use this strategic period to cooperate and invest in economic measures to protect themselves from future tariffs, sanctions, and other global trade wars. Furthermore, given the technology and systems needed to counteract criminal activities such as money laundering, which may arise because of trade wars, their discussions should also include monitoring and implementing measures to prevent money laundering and other related crimes in Asian markets. Hence, during present and future discussions with the US, Asian countries should emphasize the development of enhanced cooperative frameworks for tackling money laundering during such tariff-based trade wars, which could hinder the economic growth of the US and Asian countries alike. Therefore, while it may not stop trade-based money laundering, collective efforts by ASEAN and other partnerships could reduce crime and find ways to strengthen national economies.

Footnotes

[1] APG, ‘The International AML/CFT Standards’, 2025 URL: https://apgml.org/about-us/page.aspx?p=acbf69ba-a694-4db0-b1be-f27172dde9fc

[2] Financial Action Task Force, ‘Trade-Based Money Laundering’ Publications, 2024, URL: https://www.fatf-gafi.org/en/publications/Methodsandtrends/Trade-basedmoneylaundering.html

[3] IMF, ‘Financial Crimes Hurt Economies and must be better understood and Curbed’, Carolina Claver, Chady El Khoury, Rhoda Weeks-Brown, 7 December 2023 URL: https://www.imf.org/en/Blogs/Articles/2023/12/07/financial-crimes-hurt-economies-and-must-be-better-understood-and-curbed#:~:text=Potential%20financial%20stability%20impacts%20include,trust-in%20governments%20and%20institutions.

[4] Reuters, ‘The rise of emerging markets in Asia’ Russell Beattie, CME Group, 2023 URL: https://www.reuters.com/plus/the-rise-of-emerging-markets-in-asia

[5] Trinh, ‘Trumps Economics’ X, 3 April 2025, URL: https://x.com/Trinhnomics/status/1907741043568869381

[6] Reuters, ‘Southeast Asian nations, among hardest-hit by Trump Tariffs, seek talks’ Francesco Guarascio and Orthai Sriring, 3 April 2025 URL: https://www.reuters.com/world/asia-pacific/southeast-asia-nations-hit-particularly-hard-by-us-tariffs-prep-talks-with-trump-2025-04-03/

[7] Office of the United States Trade Representative, ‘Countries and Regions’, 2024, URL: https://ustr.gov/countries-regions

[8] ING, ‘The Impact of Trump’s tariffs so far’ Marieke Blom, 7 April 2025, URL: https://think.ing.com/opinions/the-impact-of-trump-tarriffs-so-far/

[9] Chatham House, ‘Trump’s tariffs will push Southeast Asia uncomfortably close to China’ Ben Bland, 8 April 2025, URL: https://www.chathamhouse.org/2025/04/trumps-tariffs-will-push-southeast-asia-uncomfortably-close-china

[10] Dynamis LLP, ‘Tariff Hikes, Trade Fraud, and Enforcement: White Collar Risks of Trump’s New Duties’ Eric Rosen, 6 April 2025 URL: https://www.dynamisllp.com/knowledge/tariff-increases-customs-fraud-enforcement-risks

[11] Sanction Scanner, ‘Trump’s tariffs: a new era of sanctions compliance challenges’ Team Sanction Scanner – Compliance, 10 April 2025, URL: https://www.sanctionscanner.com/blog/trumps-tariffs-a-new-era-of-sanctions-compliance-challenge-1009

[12] Basel AML Index, ‘Global Money Laundering Risks in 2024’ Public Edition, 2024, URL: https://index.baselgovernance.org/map

[13] ArentFox Schiff, ‘Trump Tariffs: What Importers need to know about customs fraud and the increased use of the False Claims Act’, Nadia Patel, Jackson David Toof, Mario A Torrico, 4 March 2025 URL: https://www.afslaw.com/perspectives/investigations-blog/trump-tariffs-what-importers-need-know-about-customs-fraud-and-the?utm_source=chatgpt.com

[14] JD Supra ‘Criminal Enforcement of the Trump Tariffs is Likely – Here’s what it will look like’ Artie McConnell, Michael Snarr, Jenniger Solari, 4 February 2025 URL: https://www.jdsupra.com/legalnews/criminal-enforcement-of-the-trump-9302313/?utm_source=chatgpt.com

[15] CNN Business, ‘Trump announced 90-day pause on tariffs with exception of China’, Elisabeth Buchwald and Kevin Liptak, 9 April 2025, URL: https://edition.cnn.com/2025/04/09/business/reciprocal-tariff-pause-trump/index.html