Sovereignty at Stake: A Strategic Critique of the Türkiye–Somalia Hydrocarbons Agreement

A comparative analysis of recent Somali petroleum agreements and the implications of opaque bilateral energy deals on sovereignty, transparency, and state-building.

Abstract

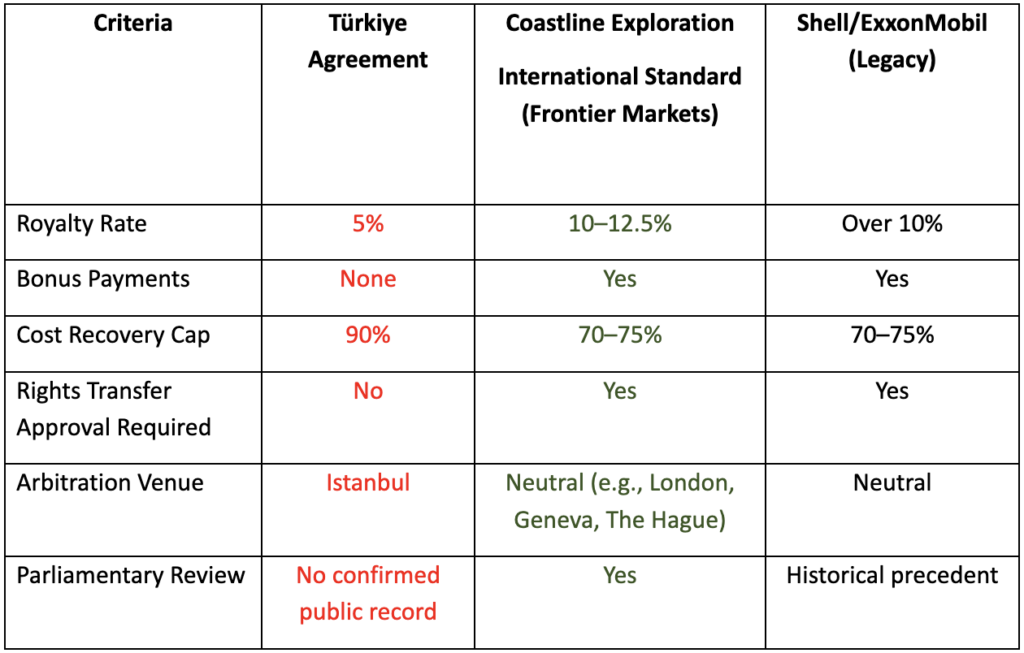

This article critically evaluates the Türkiye-Somalia hydrocarbons agreement through both policy and Islamic legal frameworks. Drawing on comparative petroleum contracts and classical Islamic jurisprudence, this article argues that the deal undermines national sovereignty, lacks transparency, and violates principles of distributive justice. By comparing the Türkiye agreement to contracts with Coastline Exploration and Shell/ExxonMobil, and drawing upon the insights of scholars like al-Māwardī and Ibn Taymiyyah, this paper offers recommendations for more equitable and transparent resource governance in Somalia.

Introduction

In February 2024, the Federal Government of Somalia quietly entered into a bilateral hydrocarbons exploration and production agreement with the Republic of Türkiye. Reportedly signed without parliamentary scrutiny, civil society input, or public consultation, the deal has raised serious concerns over its legality, transparency, and long-term implications for Somalia’s sovereignty. This article critically examines the Türkiye-Somalia hydrocarbons agreement through both policy and Islamic legal lenses, compares it with other Somali petroleum deals—including those with Coastline Exploration and Shell/ExxonMobil—and assesses the broader governance and strategic risks involved.

Erosion of Sovereignty: Clause 4.3 and the Control of Resources

Clause 4.3 permits Türkiye’s designated entity to assign or transfer interests, shares, and obligations without requiring approval from the Somali government. While the agreement acknowledges Somalia’s constitutional ownership of its natural resources, this clause effectively outsources critical state functions. By contrast, the Coastline Exploration deal explicitly requires government consent for any assignment of rights.

This contravenes classical Sunni jurists such as Imam al-Māwardī (al-Ahkam al-Sultaniyyah), who emphasised that the head of state (Imam) must protect state authority and cannot cede control over public resources unless it brings clear public benefit (maslahah).

Financial Asymmetry: Royalties, Bonuses, and Cost Recovery

The financial terms in the Türkiye agreement diverge sharply from international norms:

- Royalties: capped at 5% (Clause 4.6) versus global benchmarks of 10–20%

- Bonuses: absent (Clause 4.5)

- Cost recovery: allows Türkiye to recover up to 90% of costs before profit-sharing

By contrast, the Coastline Exploration deal includes a 10–12.5% royalty and bonuses, and the Shell/ExxonMobil contracts maintained more balanced cost recovery limits.

This creates injustice in the distribution of public wealth, violating the Qur’anic injunction:

“Do not consume one another’s wealth unjustly or send it [in bribery] to the rulers in order that [they might aid] you to consume a portion of the wealth of others while you know [it is unlawful].” (Surah al-Baqarah 2:188)

Ibn Taymiyyah emphasized that a just ruler must prioritize the financial benefit of the Ummah and cannot allow the public treasury to be exploited under the guise of foreign partnership.

Legal Risk and Dispute Resolution: Clause 10.7

Clause 10.7 mandates arbitration under UNCITRAL rules but sets the venue as Istanbul. While UNCITRAL is neutral in procedure, selecting Türkiye’s capital as the venue—given the political stake of the Turkish government—compromises the perception of impartiality.

Islamic governance mandates justice in all legal processes. Ibn Qudamah (Hanbali) ruled that a just leader must ensure both fairness and public confidence in dispute mechanisms. Arbitration should occur in neutral venues, such as The Hague or Geneva, to fulfill the Qur’anic command:

“Indeed, Allah commands you to render trusts to whom they are due and when you judge between people to judge with justice. Excellent is that which Allah instructs you. Indeed, Allah is ever Hearing and Seeing.” (Surah an-Nisā’ 4:58)

Transparency Violations and Legal Irregularities

Somalia’s 2019 Petroleum Law (Articles 6, 7, 11) requires transparency, public disclosure, and parliamentary oversight of all resource contracts. The Türkiye deal, reportedly signed in secrecy and only revealed following international inquiry, raises significant questions about compliance with these legal safeguards.

In Islamic governance, shūra (consultation) is not optional but essential. As Allah commands:

“…And consult with them in affairs. Then when you have decided, put your trust in Allah. Indeed, Allah loves those who rely [upon Him].” (Surah Āl ‘Imrān 3:159)

Imam al-Ghazālī in Nasihat al-Muluk stresses that lack of consultation invalidates public trust and endangers justice.

Comparison of Petroleum Agreements

Strategic Expansion: Turkey’s Long-Term Objectives

The Türkiye-Somalia hydrocarbons agreement builds upon a March 2024 cooperation deal that granted Turkey exclusive rights to explore and develop three offshore blocks totaling 5,000 square kilometers. Beginning in late 2025, these areas are set to be surveyed using the Oruç Reis seismic research vessel, supported by Turkish naval ships. This initiative is part of Ankara’s broader “Africa Opening Strategy,” which seeks to strengthen geopolitical influence and secure energy access across the continent.

Turkey’s domestic energy demand is projected to grow by 55% by 2050, with fossil fuels still constituting over 80% of its energy mix. As such, Somalia’s estimated 30 billion barrels of offshore hydrocarbon reserves are strategically important to Ankara’s long-term energy policy.

The agreement itself offers Türkiye highly favourable operational and financial terms. Under Article 4.5, Turkey is exempt from paying any signature, development, or production bonuses, as well as surface or administrative fees. Article 4.7 allows for a 90% cost recovery rate, while Article 4.8 provides Turkey full export rights and revenue retention abroad. Security-related expenses (Article 6) are also cost-recoverable, and any disputes are subject to arbitration under the ICSID Convention, with Istanbul as the seat (Article 9).

Together, these provisions consolidate Türkiye’s commercial, military, and legal presence in Somalia and offer one of the most favorable frameworks for a foreign actor operating in East Africa.

Broader Strategic Implications

Türkiye’s involvement in Somalia extends beyond hydrocarbons. It includes military bases, ports, and major infrastructure contracts. While partnership can be beneficial, concentrating multiple sectors of national development in one foreign actor’s hands creates dependency.

Ibn Taymiyyah warned against allowing external powers to gain strategic control over Muslim lands, especially in economic and military domains. A righteous leader must ensure alliances are balanced, reviewed, and do not compromise sovereignty.

Recommendations and Conclusion

In its current form, the Türkiye-Somalia hydrocarbons agreement fails to uphold the principles of transparency, justice, and national sovereignty mandated by both Somali law and Sunni political thought. It represents a departure from previous agreements in fiscal fairness, legal protection, and strategic planning.

Recommendations:

- Immediate legal review in compliance with the 2019 Petroleum Law.

- Public disclosure and parliamentary ratification before enforcement.

- Re-negotiation of terms to include:

- Increased royalties and bonuses

- Limitation of cost recovery to international standards (70%)

- Arbitration in neutral international venues

- Governmental approval for rights transfer

By aligning future agreements with Islamic principles of amānah, shūra, and maslahah, Somalia can protect its people, its resources, and its sovereign future.

Bibliography

Coastline Exploration Ltd., 2022. Somalia Open for Business as President Throws His Support at Major Oil Exploration Agreement. [online] Newswire.ca. Available at: https://www.newswire.ca/news-releases/somalia-open-for-business-as-president-throws-his-support-at-major-oil-exploration-agreement-816934893.html [Accessed 24 Apr. 2025].

Federal Republic of Somalia, 2019. Petroleum Law. [pdf] Available at: https://mopmr.gov.so/wp-content/uploads/2025/03/SOMALI-PETROLUEM-LAW-FEB-2020-1.pdf [Accessed 24 Apr. 2025].

Kenez, L., 2025. Turkey secures rights to 90 percent of oil and gas output in Somalia deal, document shows. [online] Nordic Monitor. Available at: https://nordicmonitor.com/2025/04/turkey-secures-exceptional-rights-in-somalia-oil-agreement-documents-show/ [Accessed 24 Apr. 2025].

Reuters, 2020. Shell and ExxonMobil revive Somali oil agreements. [online] Available at: https://www.reuters.com/article/idUSKBN1X70V8/ [Accessed 24 Apr. 2025].

Shaw, A., 2024. Turkey signs agreement for oil exploration in Somalia. [online] Offshore-technology.com. Available at: https://www.offshore-technology.com/news/turkey-to-explore-oil-fields-in-somalia/ [Accessed 24 Apr. 2025].

Transparency International, n.d. Natural Resource Governance. [online] Available at: https://knowledgehub.transparency.org/topics/natural-resource-governance [Accessed 24 Apr. 2025].

UNCITRAL, 2010. UNCITRAL Arbitration Rules (as revised in 2010). [pdf] Available at: https://docs.pca-cpa.org/2016/01/UNCITRAL-2010-English.pdf [Accessed 24 Apr. 2025].