Pipeline Politics: How Infrastructure Shapes Central and Eastern Europe’s Dependence on Russia

The 2022 Russian invasion of Ukraine produced many detrimental consequences. One of those consequences was the realization by the European Union that it was heavily dependent on Russia as the predominant supplier of energy. The EU quickly launched the REPowerEU Plan to end its reliance on Russian energy (European Commission, 2022).

However, Central and Eastern Europe remain tied to Russia not only because it provides a relatively cheap source of energy but also because the existing infrastructure cements their dependence on Russia. The necessary infrastructure for a complete cessation of Russian energy imports does not exist. With no available long-term alternative, no alternate pipelines or refineries are available to limit Russia’s energy imports.

Ghosts of the Past – Existing Infrastructure

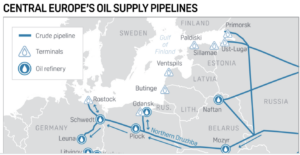

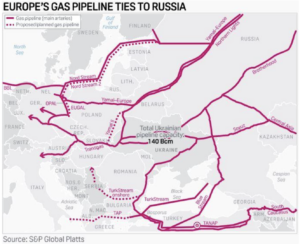

During the Cold War, the Soviet Union developed the energy infrastructure of Central and Eastern Europe. It built refineries, pipelines and storage facilities for crude oil and natural gas sourced from Western Siberia and the Volga-Urals regions.

The most significant oil pipeline is the Druzhba (Friendship) pipeline, which became operational in 1964. Druzhba has the capacity to deliver up to two million barrels per day of crude oil from Russia to Europe.

With regards to natural gas infrastructure, there are several important pipelines such as the Urengoy–Pomary–Uzhhorod (Brotherhood) and the Soyuz pipelines. These carry natural gas to southern Central Europe, while the Yamal-Europe and the Nord stream pipelines carry natural gas from the Yamal field in northern Russia to northern Central Europe.

Many of these pipelines have been operational for decades and despite the fall of the Soviet Union, the infrastructure and the dependence remained in place. This inheritance has locked Central and Eastern Europe into a quagmire. Unless new refineries, port terminals and pipelines for both crude oil and natural gas are developed, these countries will remain dependent.

Proposed Solutions and Potential Opportunities

The EU’s programme to phase out Russian energy, REPowerEU, set out a number of objectives, including efficiency schemes, diversifying energy supplies and investing in green technology. However, since its launch in May 2022, this programme has not yielded the desired results (European Court of Auditors, 2022). Many EU member states-especially in Central and Eastern Europe-still import large amounts of gas and oil, either through exemptions to sanctions, through willing third parties or through the use of Russia’s ‘shadow’ fleet of tankers (CREA, 2025). Fundamentally, REPowerEU fails to tackle the underlying reason for the dependence on Russian energy; infrastructure.

Similarly, ad-hoc solutions like Floating Storage and Regasification Units (Port news, 2025; Wettengel, 2024) and private sector energy traders are not long-term sustainable solutions (Geri, 2025).

If the EU, and Central and Eastern Europe in particular, wish to phase out Russian energy, it must make long-term serious investments in a new energy infrastructure network. This would include new pipelines, crude oil and LNG terminals as well as refineries. Such an expansion of the infrastructure would fortify Central and Eastern Europe’s energy supply against unforeseeable geopolitical risks by creating dissimilar redundancy within the system.

New Infrastructure

Certain countries have already attempted to improve their infrastructure.

- Romania has committed to expanding its gas extraction efforts as well as its pipeline infrastructure (Fabian, 2025; Gotev, 2025).

- Poland has invested in expanding the LNG terminal in Świnoujście from 6.2 bcm to 8.3 bcm and has also begun work on an additional terminal in Gdańsk (Nikše, 2024).

- The Three Seas Initiative has become a forum for Eastern and Southern Europe to coordinate their efforts on new pipelines and LNG terminals (EMBER, 2025).

- Hungary is constructing a new oil pipeline to Serbia (Reuters, 2025) and exploiting newly discovered reserves (MOL, 2025).

- Croatia has approved the construction of the Zlobin-Bosiljevo gas pipeline and is expanding the capacity of the LNG terminal in Krk (HINA, 2024).

- Additional pipelines and LNG terminals in Southern Europe (Hess, 2025).

New Sources

A new and diversified energy import and transportation infrastructure would provide these countries with flexibility in choosing their suppliers. There are many potential suppliers that would complement this new infrastructure using numerous untapped gas fields within the British EEZ that are yet to be considered (Cavcic, 2025). Additionally, there are potential opportunities in the eastern Mediterranean (Godwin, 2025) as well as new oil and gas fields across Central Europe (Kazanci, 2025; Kern, 2025) that ought to be considered. New partners in North Africa, especially Libya and Algeria, have also proven their ability to be reliable suppliers (Haytayan, 2025).

On another front, France has been the leader in nuclear power, which now makes up 40.3% of France’s energy mix (IEA, no date). Some countries are already expanding their efforts in this area-Hungary (Dalton, 2025; Gencturk, 2025)-while in others, such as Germany, it has become a contentious political issue (Alkousaa, 2023; WNA, 2024). Nuclear power could also potentially eliminate the need for an expensive and expansive fossil fuel pipeline infrastructure (Judah, B. et al., 2023).

A Long-Term Project

The diversification of Europe’s energy infrastructure is a long-term project. Oil and gas pipelines take an average of 3-4 years to complete. Similarly, LNG tankers require specialised terminals, which can take 5 years to construct. While crude oil terminals are more available in Europe-with six major terminals operating in Central Europe-they can also take years to construct.

Additionally, there are many accompanying facilities which are necessary to support the transportation and electrification of fossil fuel energy imports. These include; pressurisation/ compression stations, processing plants, local distribution centres, gate stations, power plants, refineries, transformers, pumping stations and storage facilities. These also require significant time and capital to construct.

Therefore, if the EU-Central and Eastern Europe in particular-wishes to phase out Russian energy, it must make serious long-term investments in their infrastructure. These projects can take years and billions of euros to complete. Consequently, these countries should begin these efforts promptly.

Bibliography

Alkousaa, R. (2023) “Atomic angst over? Germany closes last nuclear plants.” Reuters. Published 15th April 2023. Available at: https://www.reuters.com/world/europe/atomic-angst-over-germany-closes-last-nuclear-plants-2023-04-14/

Cavcic, M. (2025) “Multi-billion projects at stake: Another blow for UK’s largest untapped oil & gas duo but Shell, Equinor, and Ithaca remain upbeat.” Offshore Energy. Published 3rd February 2025. Available at: https://www.offshore-energy.biz/multi-billion-projects-at-stake-another-blow-for-uks-largest-untapped-oil-gas-duo-but-shell-equinor-and-ithaca-remain-upbeat/

CREA. (2025) “EU imports of Russian fossil fuels in third year of invasion surpass financial aid sent to Ukraine.” Centre for Research on Energy and Clean Air. Published 24th February 2025, Updated 10th April 2025. Available at: https://energyandcleanair.org/publication/eu-imports-of-russian-fossil-fuels-in-third-year-of-invasion-surpass-financial-aid-sent-to-ukraine/

Czyzak, P. (2025) “10th Three Seas Summit: From gas trap to clean power and connectivity.” EMBER. Published 17th April 2025. Available at: https://ember-energy.org/latest-insights/10th-three-seas-summit-from-gas-trap-to-clean-power-and-connectivity/

Dalton, D. (2025) “Russian Specialists Begin Forging Work For Unit 2 Components At Hungary’s Paks II.” Nucnet. Published 8th April 2025. Available at: https://www.nucnet.org/news/russian-specialists-begin-forging-work-for-unit-2-components-at-hungary-s-paks-ii-4-2-2025

European Commission (2022) REPowerEU: affordable, secure and sustainable energy for Europe. European Commission. Available at: https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal/repowereu-affordable-secure-and-sustainable-energy-europe_en

European Court of Auditors. (2022) “REPowerEU could fall short of ambitions, EU auditors warn.” European Court of Auditors [Press Release]. Published 26th July 2022. Available at: https://www.eca.europa.eu/en/Pages/news.aspx?nid=16923

Fabian, E. (2025) “Romania is expanding its pipeline capacity with its neighbours.” Ceenergy News Published 10th March 2025. Available at: https://ceenergynews.com/oil-gas/romania-is-expanding-its-pipeline-capacity-with-its-neighbours/

Geri, M. (2025) “The West’s Secret Energy Weapon.” German Marshall Fund. Published 7th April 2025. Available at: https://www.gmfus.org/news/wests-secret-energy-weapon

Gencturk, A. (2025) “Hungary inks deal with UK to develop small modular nuclear reactors.” AA. Published 30th January 2025. Available at: https://www.aa.com.tr/en/europe/hungary-inks-deal-with-uk-to-develop-small-modular-nuclear-reactors/3466864

Godwin, B. (2025) “Cyprus — A European Energy Savior?” CEPA. Published 16th January 2025. Available at: https://cepa.org/article/cyprus-a-european-energy-savior/

Gotev, G. (2025) “Romania on its way to become EU’s largest gas producer.” Euractiv. Published 10th January 2025. Available at: https://www.euractiv.com/section/politics/news/romania-on-its-way-to-become-eus-largest-gas-producer/

Haytayan, L. (2025) “EU-North Africa Energy Partnerships: Is a Win-Win Formula Possible?” Natural Resource Governance Institute. Published 29th January 2025. Available at: https://resourcegovernance.org/publications/eu-north-africa-energy-partnerships-win-win-formula-possible

Hess, M. (2025) “How Eastern Europe Overhauled Its Natural Gas Market.” Carnegie Endowment. Published 22nd April 2025. Available at: https://carnegieendowment.org/research/2025/04/how-eastern-europe-overhauled-its-natural-gas-market?lang=en

HINA (2024) “The Commission approved state aid for the expansion of the LNG terminal on Krk.” European News Room. Published 6th May 2024. Available at: https://europeannewsroom.com/the-commission-approved-state-aid-for-the-expansion-of-the-lng-terminal-on-krk/#:~:text=In%20August%202022%2C%20the%20Croatian,(May%206%2C%202024.)

IEA. (no date) France – Energy Mix. International Energy Agency. Available at: https://www.iea.org/countries/france/energy-mix

Judah, B. et al. (2023) “How to strike a grand bargain on EU nuclear energy policy.” Atlantic Council. Published 16th October 2023. Available at: https://www.atlanticcouncil.org/in-depth-research-reports/report/how-to-strike-a-grand-bargain-on-eu-nuclear-energy-policy/

Kazanci, H. (2025) “Turkish, Hungarian national oil companies to begin exploration at 2 sites in Hungary.” AA. Published 1st May 2025. Available at: https://www.aa.com.tr/en/economy/turkish-hungarian-national-oil-companies-to-begin-exploration-at-2-sites-in-hungary/3553920

Kern, M (2025) “Europe’s Top 5 Untapped Gas Reserves.” Oil Price. Published 5th March 2025. Available at: https://oilprice.com/Energy/Natural-Gas/Europes-Top-5-Untapped-Gas-Reserves.html

MOL (2025) “MOL discovered a new oil field in Western Hungary.” MOL [Press Release]. Published 18th March 2025. Available at: https://molgroup.info/en/media-centre/press-releases/mol-discovered-a-new-oil-field-in-western-hungary-2

Nikše, D. (2024) “With building permit secured, Polish FSRU project ready for execution stage.” Offshore Energy. Published 10th December 2024. Available at: https://www.offshore-energy.biz/with-building-permit-secured-polish-fsru-project-ready-for-execution-stage/

Port News. (2025) “Excelsior FSRU arrives at Wilhelmshaven.” Port News. Published 29th April 2025. Available at: https://en.portnews.ru/news/376540/

Reuters. (2025) “Hungary could meet Serbia’s oil needs with new pipeline from 2028, minister says.” Reuters. Published 2nd April 2025. Available at: https://www.reuters.com/business/energy/hungary-could-meet-serbias-oil-needs-with-new-pipeline-2028-minister-says-2025-04-02/

Wettengel, J. (2024) “Germany to have two more floating LNG import terminals in operation by winter – operator.” Clean Energy Wire. Published 7th October 2024. Available at: https://www.cleanenergywire.org/news/germany-have-two-more-floating-lng-import-terminals-operation-winter-operator

WNA. (updated 2024) “Nuclear Power in Germany.” World Nuclear Association. Updated 8th July 2024. Available at: https://world-nuclear.org/information-library/country-profiles/countries-g-n/germany