Not Your Father’s Cold War: What U.S.-China Tensions Mean for Global Business

Introduction:

President Trump’s second term has heightened tensions between the U.S. and China, creating a volatile environment for the private sector. Trade wars, technological decoupling, and geopolitical uncertainty are already materialising as significant risks. The administration initially imposed a 145% tariff on Chinese goods—later scaled back to 30% following a tentative truce that “set a path for future discussions” (Aratani L., 2025).

Even with the trade war officially paused, instability continues to shape U.S.-China relations and undermine future cooperation. Top U.S. officials, including Defence Secretary Pete Hegseth and Treasury Secretary Scott Bessent, have accused Beijing of ‘sowing division across Asia’ and labelled it an ‘unreliable partner.’ Meanwhile, the State Department has signalled ‘aggressive’ action against Chinese students in the U.S. (Davidson, H., 2025; Svirnovskiy, G., 2025; Cadell, C. and Westfall, S., 2025). In this context, talk of a ‘new cold war’ has intensified (Abrams, E. 2022). Yet, such analogies oversimplify today’s realities. Unlike the U.S. and Soviet Union, the U.S. and China remain deeply economically interdependent—a relationship that generates friction but also opens avenues for resilience and innovation.

This analysis explores key differences between the Cold War and contemporary U.S.-China competition, focusing on trade, technology, and private sector strategy. In doing so, it contests fatalistic narratives and emphasises how businesses can prosper during a period of geopolitical flux.

Comparative Data:

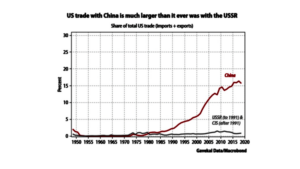

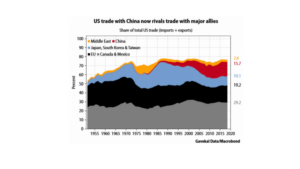

Recent trade data underscores the stark contrast between the Cold War and the current U.S.-China dynamics. As the graphs illustrate, U.S. trade with China has grown exponentially since the 1970s, and now accounted for 15–20% of total U.S. trade—vastly exceeding the Soviet Union’s historic peak of just 1–2% (Batson, 2019). China’s share now rivals that of longstanding allies such as the EU, Canada, and Mexico—an unimaginable scenario during the Cold War.

This structural interdependence is foundational. Where the U.S.-Soviet relationship was defined by separation, today’s U.S.-China rivalry is grounded in integration, complicating efforts toward full economic decoupling.

Risk facing the Private Sector:

Trade War and Supply Chain Disruptions:

The Trump administration’s 145% tariffs—reduced to 30% after market backlash—have disrupted long-established supply chains and increased costs for manufacturers and retailers. U.S. manufacturing has contracted for three consecutive months in 2025, and the OECD projects that U.S. growth will slow to just 1.6% this year (Mutikani, L., 2025; Gopalan, N., 2025). Large firms like Best Buy have begun reducing reliance on Chinese imports, but smaller firms face steeper challenges adjusting (Nassauer, S., Kapner, S. and Chen, T.-P., 2025). As these disruptions become more acute, political pressure may constrain the administration’s appetite for deeper decoupling. Trump’s rollback of tariffs already suggests a pragmatic limit to how far economic separation will go, despite hardline rhetoric.

Technological Decoupling and Innovation Risk:

In a bid to protect national security, the U.S. has tightened export controls on advanced computing and semiconductor technologies destined for China. These measures, however, come at a cost. Nvidia recently reported a $5.5 billion financial hit due to the ban on its H20 AI chips to China, illustrating the commercial fallout for U.S. tech firms (CNN, 2025). Furthermore, the revocation of visas for Chinese students in fields like engineering and computer science is raising alarms in the tech industry. Critics warn that cutting off this talent pipeline weakens America’s competitive edge in innovation. Together, these shifts signal an economic and technological decoupling that affects not just hardware and software, but also human capital. While the risks are real and mounting, they are not the full story.

Opportunities for the Private Sector:

Unlike during the Cold War, today’s private sector can pivot rather than retreat. Many firms have begun diversifying production through “China Plus One” strategies, shifting manufacturing to emerging markets such as Vietnam, India, and Mexico to reduce geopolitical risk. Apple, for example, has significantly expanded its operations in India, with shipments from the country to the U.S. up 76% in April (Times of India, 2025). Meanwhile, smaller American firms are exploring near-shoring in Mexico, leveraging proximity and trade frameworks like USMCA to bolster resilience (Lellouche Tordjman, K., McAdoo, M., Pulido, M. and León, E., 2024).

The rivalry has also catalysed investment in next-generation technologies. U.S. venture capital is pouring into sectors like biotech, quantum computing, and EVs. The Biden administration committed over $3 billion to build out domestic EV battery production across 14 states (Shepardson, D., 2024). Strategic partnerships—such as the Initiative on Critical and Emerging Technology with India—are also enabling R&D cooperation that was unthinkable in the Cold War era (Carnegie Endowment for International Peace, 2025).

Strategic Recommendations for the Private Sector:

- Diversify Supply Chains: Firms should proactively assess vulnerabilities and expand sourcing to reduce exposure to geopolitical shocks. Flexibility will be a core asset in this era of instability.

- Invest in Innovation and Talent: Continued investment in R&D, alongside policies that attract top global talent, will be critical to maintaining a competitive edge and fostering cross-border collaboration on innovation.

- Engage Policymakers: Businesses must advocate for regulatory clarity and policies that protect national security without stifling global collaboration.

Conclusion:

President Trump’s second term has undeniably sharpened U.S.-China tensions. But framing this competition as a “new Cold War” risks obscuring the defining feature of today’s rivalry: deep economic interdependence. While challenges abound—tariffs, tech restrictions, and strained diplomacy—opportunities also exist. For the private sector, the path forward lies in adaptation, not retreat. Through strategic repositioning and innovation, businesses cannot only withstand global instability but also act as stabilisers in a fragmented geopolitical landscape. In doing so, they may demonstrate that even amid strategic rivalry, cooperation and growth remain possible.

Bibliography:

Abrams, E. (2022) ‘The New Cold War’, Council on Foreign Relations, 4 March. Available at: https://www.cfr.org/blog/ new-cold-war-0 (Accessed: 2 June 2025).

Aratani, L. (2025) ‘China has “totally violated” its trade agreement with the US, says Trump’, The Guardian, 30 May. Available at: https://www.theguardian.com/us-news/2025/may/30/trump-china-tariffs-trade (Accessed: 5 June 2025)

Batson, A. (2019) ‘The difference between the new and old Cold Wars’, The Tangled Woof, 12 May. Available at: https:// andrewbatson.com/2019/05/12/the-difference-between-the-new-and-old-cold-wars/ (Accessed: 6 June 2025).

Cadell, C. and Westfall, S. (2025) ‘Trump administration claims Chinese students “exploit” U.S. universities’, The Washington Post, 1 June. Available at: https://www.washingtonpost.com/national-security/2025/06/01/china-us students-national-security-threat/ (Accessed: 2 June 2025).

Carnegie Endowment for International Peace (2025). India-U.S. Emerging Technologies Working Group. Carnegie Endowment for International Peace. Available at: https://carnegieendowment.org/india/india-us-emerging-technologies working-group?utm_source=chatgpt.com&lang=en

CNN (2025) ‘Nvidia shares plunge after U.S. bans H20 chip exports to China’, CNN, 16 April. Available at: https:// edition.cnn.com/2025/04/16/tech/nvidia-plunge-h20-chip-china-export-intl-hnk/index.html (Accessed: 5 June 2025).

Davidson, H. (2025) ‘China accuses Pete Hegseth of sowing division in Asia in speech “filled with provocations”‘, The Guardian, 1 June. Available at: https://www.theguardian.com/world/2025/jun/01/china-accuses-pete-hegseth-of-sowing division-in-asia-in-speech-filled-with-provocations (Accessed: 4 June 2025)

Financial Times. (2025) ‘The great Trump riddle on China’, Financial Times, 3 June. Available at: https://www.ft.com/ content/d64c3009-0f5b-4ecb-93e4-cbaf74580efc (Accessed: 3 June 2025).

Gopalan, N. (2025) ‘OECD slashes US growth outlook on tariffs, uncertainty’, Investopedia, 3 June. Available at: https://www.investopedia.com/oecd-slashes-us-growth-outlook-on-tariffs-uncertainty-11747055 (Accessed: 5 June 2025).

Lellouche Tordjman, K., McAdoo, M., Pulido, M. and León, E. (2024) ‘The shifting dynamics of near shoring in Mexico’, Boston Consulting Group, 5 September. Available at: https://www.bcg.com/publications/2024/shifting dynamics-of-nearshoring-in-mexico (Accessed: 2 June 2025).

Mutikani, L. (2025) ‘Tariff gloom weighs on US manufacturing; delivery times lengthening’, Reuters, 2 June. Available at: https://www.reuters.com/world/us/us-manufacturing-remains-subdued-may-delivery-times-lengthening-2025-06-02/ (Accessed: 4 June 2025).

Nassauer, S., Kapner, S. and Chen, T.-P. (2025) ‘Retailers, ducking trade-war curveballs, stick to their plans’, The Wall Street Journal, 29 May. Available at: https://www.wsj.com/business/retail/trump-tariff-court-ruling-kohls-best buy-20cb2708 (Accessed: 4 June 2025).

Shepardson, D. (2024) ‘US to award $3 billion to 25 projects for battery manufacturing sector’, Reuters, 20 September. Available at: https://www.reuters.com/business/energy/us-award-3-billion-25-projects-battery-manufacturing sector-2024-09-20/ (Accessed: 4 June 2025).

Svirnovskiy, G. (2025) ‘Bessent says China already violating its latest trade deal’, Politico, 1 June. Available at: https:// www.politico.com/news/2025/06/01/bessent-china-violating-trade-deal-00379586 (Accessed: 4 June 2025)

Times of India (2025) ‘Apple exports 2.9 million iPhones from India to US, China sees big fall: How and why 25% tariff threat may not solve Trump’s “little problem” with Apple’, The Times of India, 30 May. Available at: https:// timesofindia.indiatimes.com/technology/tech-news/apple-exports-2-9-million-iphones-from-india-to-us-china-sees-big fall-how-and-why-25-tariff-threat-may-not-solve-trumps-little-problem-with-india/articleshow/121511222.cms (Accessed: 2 June 2025).