Political Instability and Currency Depreciation in Argentina

Argentina’s political instability has had a serious impact on the Argentine peso and investment risks. The peso has endured longstanding devaluation due to political and economic misgovernance, increasing macroeconomic volatility (inflation, debt crisis…). New policies by the right-wing populist government of recently elected Javier Milei, present potential recovery opportunities. Although investment opportunities remain high risk due to volatility, there are some industries that could prove to be promising if proper risk mitigation strategies are implemented.

Argentina’s Political and Economic Instability

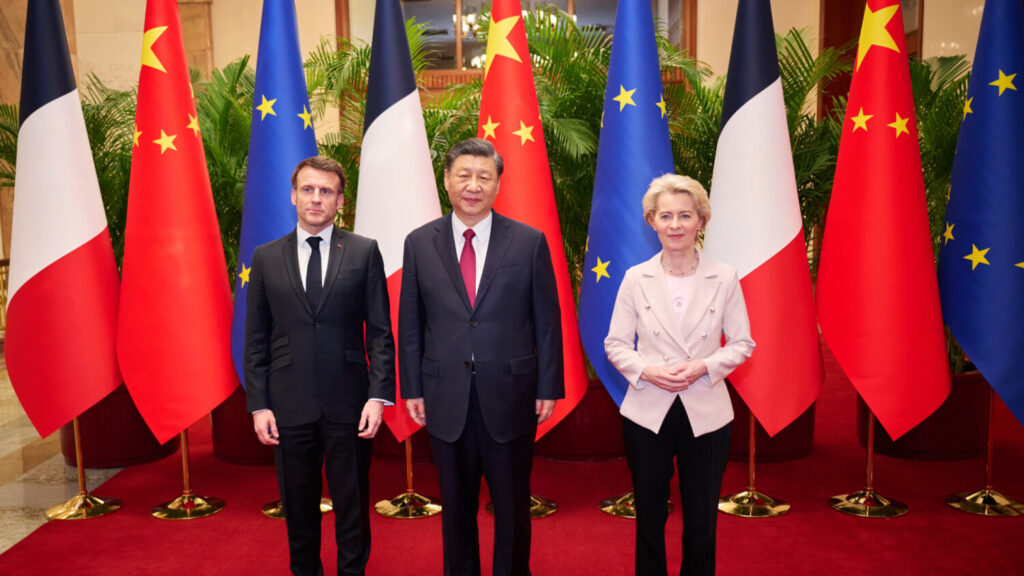

The economic history of Argentina is marked by recurring currency crises, such as the hyperinflation of the 1980s, the 2001 default, and the 2018 IMF rescue (Ocampo, 2021). All these crises tended to emanate from excessively expansionary macroeconomic policies that manifested in high inflation and uncontrollable balance of payments problems (Sachs, 1989). Populist policies, designed to increase the incomes of poorer groups, tended to exacerbate debt and inflation (Edwards, 2019). Argentina faces significant macroeconomic challenges. Inflation is a huge problem, reaching an inflation rate of 25.5% in December 2023, although we can observe an apparent decrease since then (INDEC). Its debt reliance, with a record of IMF bailouts, poses sovereign debt risk (Pollock, 2021). Capital flight and a lack of foreign direct investment (FDI) add to the economy’s complexity (Libman and Stanley, 2022).

Graph1- Argentina’s Inflation rate (2022-2025)

Argentina’s Economic Strengths

Argentina offers robust investment appeals due to its abundant natural resources and pro-business reforms undertaken recently. As one of the world’s leading exporters, it supplies immense quantities of soy meal and oil, corn, wheat, beef, and lithium, a critical input for electric cars batteries (OEC; Hernan Nessi, 2025). Its new President, Javier Milei, sworn in in December 2023, proposed ambitious free-market reforms with vigorous fiscal austerity and deregulation designed to stimulate the economy. Additionally, Argentina’s elevated interest rates enable carry trade, where investors can profit from favourable yield differentials. Collectively, these factors boost Argentina’s appeal as a destination for strategic investments.

Currency Instability and Sovereign Debt Challenges

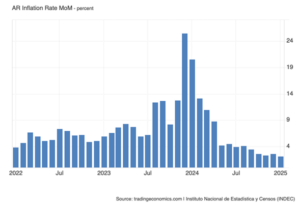

The sudden depreciation of the Argentine peso, as shown in Graph 2, illustrates how political instability has impacted the economy following the election of a right-wing populist president in December 2023. The Exchange rate plummeted from approximately 350-400 ARS/USD in late 2023 to over 800 ARS/USD in early 2024, and over 100% devaluation within a few months. This, therefore, reflects the market’s reaction to Javier Milei’s election and its radical economic agenda, linked to the broader instability surrounding Argentina’s political transition.

Graph 2- Argentine Peso Depreciation Against the US Dollar (2020-2025)

Additionally, Argentina’s past is marked by repetitive sovereign debt fault, which has become a quasi-permanent characteristic of its economy (Ocampo, 2021). Argentina has experienced frequent financial crises, which have required international bailouts and support, sometimes with strings attached by institutions such as the IMF (Ippolito, 2023). The dependence on external lending and the utilization of organisations such as the IMF and World Bank to implement free-market economic reforms has been an undercurrent throughout Argentina’s financial history (Knoell, 2024)

Pro-Business Reforms and Energy Potential

As seen in Graph 3, the sharp rise in the Merval index after the elections reflects investors’ optimism regarding pro-business reforms like deregulation and free-market reforms introduced by President Milei. Implemented appropriately, they could enhance investor confidence, attract foreign direct investment (FDI), and drive long-term economic growth. An optimal business climate could enhance Argentina’s competitiveness, leading to increased market activity and potential for further gains in the stock market.

Graph 3- Argentina Stock Market (MERVAL) (2020-2025)

Javier Milei’s administration intends to privatise inefficient and subsidized state companies or grant concessions to the private sector (Sigal, 2025). This privatisation is designed to draw investment and efficiently disseminate public goods and services through contractual obligations (Maute, 2018). There is investment potential as the policies of Milei have reduced Argentina’s national risk and attracted foreign investment in strategic sectors like mining and energy.

Lastly, Argentina, with the world’s third-largest lithium reserves, can benefit from the world’s high demand for electric car batteries. Its increasing oil and gas exports also drive economic growth, promote foreign investment, and make the country a strategic actor in the global energy shift (OEC).

Market Volatility and Social Unrest Risks

However, Graph 3 also shows that the recent decline in early 2025 indicates that investors are selling out, probably fearing the real effects of Milei’s policies. If economic reform results in social unrest, policy errors, or financial instability, the market might experience a quick correction. This would lower investors’ confidence and could lead to increased volatility, bringing long-term detrimental impacts on the Merval index and deterring new investments. Furthermore, austerity measures and subsidy cuts can lead to mass demonstrations and strikes by labourers (Moch, 2025). The IMF’s calls for the implementation of fiscal measures could eliminate social programs, leading to riots and social unrest (Ippolito, 2023), and Milei’s policies have already led to worker protests (Knoll, 2024). Argentina’s economic recovery is heavily reliant on global economic conditions, trade relations, and investor confidence. External factors, such as commodity prices, global inflation, and international financial policies, can significantly impact Milei’s reforms. The dependence on foreign capital to finance current accounts deficits must be protected from disruptions to market access and shifts in market sentiment (Maute, 2018).

Investment Outlook & Strategic Recommendations

The Argentinian government must focus on stabilizing the macroeconomic environment by ensuring effective enforcement of pro-business reforms. Reducing inflation, lowering reliance on sovereign debt, and making fiscal policy more efficient will build confidence among investors. In addition, domesticating social unrest and inclusive growth by targeted social programs can mitigate resistance and consolidate a robust economic foundation.

On the other hand, the Argentine market should be entered with caution, and risk-reducing strategies should be taken, such as diversifying portfolios and staying up to date with political developments. Growth opportunities in areas such as energy, mining, and agriculture are available but demand close monitoring of government policy and civil disturbances on market stability.

Reference List

Edwards, S. (2019). Monetary Policy, Fiscal Dominance, Contracts, and Populism. [online] Cato.org. Available at: https://www.cato.org/cato-journal/winter-2019/monetary-policy-fiscal-dominance-contracts-populism [Accessed 14 Feb. 2025].

Hernan Nessi (2025). Argentina’s Milei set to clinch trade surplus record on grains, energy exports. Reuters. [online] 17 Jan. Available at: https://www.reuters.com/world/americas/argentinas-milei-set-clinch-trade-surplus-record-grains-energy-exports-2025-01-17/.

Ippolito, S. J. (2023). An In-Depth Look into Inflation in Argentina and the United States: A Qualitative Study.

Knoell, O. (2024). Javier Milei’s Neo-Liberal Vision: Sources of Support and Resistance in Argentina – Exploratio Journal. [online] Exploratio Journal. Available at: https://exploratiojournal.com/javier-mileis-neo-liberal-vision-sources-of-support-and-resistance-in-argentina/.

Libman, E. and Stanley, L. (2022). Goodbye Capital Controls, Hello IMF Loans, Welcome Back Financial Repression. Notes on Argentina’s 2018/2019 Currency Crash. Ensayos de Economía, 32(60), pp.14–37. doi:https://doi.org/10.15446/ede.v32n60.92592.

Maute, J. (2018). Hyperinflation, Currency Board, and Bust: The Case of Argentina. [online] library.oapen.org. Peter Lang International Academic Publishers. Available at: https://library.oapen.org/handle/20.500.12657/26825.

Moch, E. (2025). Transformation from Neoclassicism to Austrian School: Javier Mileis Economic Evolution. East African Journal of Business and Economics, 8(1), 46-62.

Ocampo, E. (2021). Fiscal and Monetary Anomie in Argentina: the Legacy of Endemic Populism. [online] Available at: https://www.econstor.eu/bitstream/10419/238416/1/791.pdf [Accessed 14 Feb. 2025].

OEC (2022). Argentina (ARG) Exports, Imports, and Trade Partners. [online] oec.world. Available at: https://oec.world/en/profile/country/arg.

Pollock, J. (2021). Argentine Dependency, Devaluation, and Default: a Study of Argentine Dependency, Devaluation, and Default: a Study of Argentina’s Economic Crises from 2001 to the Present Argentina’s Economic Crises from 2001 to the Present. [online] Available at: https://digitalcommons.memphis.edu/cgi/viewcontent.cgi?article=3269&context=etd.

Sachs, J. D. (1989). Social conflict and populist policies in Latin America.

Trading Economics (2025). Argentinean Peso | 1992-2020 Data | 2021-2022 Forecast | Quote | Chart | Historical. [online] tradingeconomics.com. Available at: https://tradingeconomics.com/argentina/currency.

Trading Economics (2025). Argentina Stock Market (MERVAL) – 2022 Data – 1991-2021 Historical – 2023 Forecast. [online] tradingeconomics.com. Available at: https://tradingeconomics.com/argentina/stock-market.

Trading Economics | Instituto Nacional de Estadística y Censos (2025). Argentina Inflation Rate MoM | 2014-2020 Data | 2021-2022 Forecast | Calendar. [online] tradingeconomics.com. Available at: https://tradingeconomics.com/argentina/inflation-rate-mom.